Solving from Anywhere Insights: Impact Investing to Solve World Challenges

A global community of entrepreneurs, leaders, and investors comprised the virtual audience of MIT Solve’s fifth installment of the interactive Solving from Anywhere webinar series on August 18. This multi-faceted conversation took a deeper look into the roots of entrepreneurship, measuring its impact during times of crisis, as well as the role that impact investing can play in bridging the gaps for companies committed to social impact. Casey van der Stricht, Principal, Solve Innovation Future, MIT Solve moderated the conversation with José Manuel Moller, Founder and CEO, Solver Algramo and Greg Shell, Managing Director, Double Impact, Bain Capital.

To hear the full conversation, watch the webinar recording.

Investing in the future

For Greg Shell, a self-described “resident optimist,” the uncertainty of today’s world and that of a post-pandemic future lends itself to accelerating the change needed to address challenges in society. While Covid-19 may have stripped many of a sense of control or agency over the work they do, Shell said he feels reassured by the innovative solutions being deployed by companies small and large. “I think entrepreneurs like José give me confidence to see that not only are [global challenges] solvable, but they also lend themselves to a private sector approach.”

Even as an “ardent capitalist,” Shell drew focus to the idea that capital does not always flow naturally to the places of highest need or to those who need it most. Even in the earlier days of his career, he spent time trying to reconcile the systemic disparities and traditional structures of capitalism by balancing his time between volunteering and assessing capital flows in an attempt to pursue the social impact and change he wanted to see in the world.

“I used to think of it as sort of in my 9 to 5, I’d spend the time thinking about how capital flows… but at night I would work to address all the things that capitalism gets wrong,” he said. “I think as I’ve grown, and certainly in the work that I do with the Double Impact fund, it’s a much more integrated perspective.”

“The way capitalism ought to work”

Shell considers Bain Capital’s Double Impact fund his best chance to see his two major passions come together to capitalize on missed opportunities for investments to drive real grassroots change. He added that impact-minded businesses may attract happier employees and stand to be innovative and more profitable as a result.

He spotlighted Penn Foster, one of Bain Capital’s portfolio businesses that's focused on online education and workforce development, as a prime example of an impact-minded group that has also proven to be a worthwhile investment. Profit growth and a steady return on investment can make for a meaningful partnership, but the added value of opening socioeconomic opportunities for students can be just as rewarding.

“That, in its simplest form, is what we’re looking for in entrepreneurs, and I think backing them to help them grow feels important,” he said. “These students are verifiably better off on the other side of our investment in this business, with professional investors who can offer them tools that they wouldn’t ordinarily have access to.”

Building social impact from the ground up

While Shell has invested in hundreds of businesses and seen thousands over the span of his career, he says he could never do what entrepreneurs do every day. To wake up with the conviction to pursue solutions—while also having the humility necessary to change course—is something he admires and sees in entrepreneurs like Algramo Founder and CEO José Manuel Moller.

Moller, who is based in Chile, started Algramo to solve two key issues—one related to the cost of packaging for household products, which he calls the “poverty tax,” and another surrounding the environmental ramifications of the waste produced by that packaging. Algramo offers consumers an economic incentive with the chance to purchase in bulk with a reusable container, which has an RFID (radio-frequency identification) chip, from an IoT-connected dispenser machine. This allows users to pay ahead of time on their app, with a deposit returned to them based on how much plastic they’re saving.

As many people begin to revert back to single-use packaging and plastic products to reduce the transmission of Covid-19, Moller says the partnerships made through Algramo are becoming increasingly important to make sustainable consumption more affordable and accessible to all.

“Everyone is saying they are very concerned about the climate crisis, but when you want to purchase something, most of the time you have to pay a premium if you want to be eco-friendly,” he said. “With Algramo, we are trying to shift this habit of consumption as fast as possible… so it is cheaper and more sustainable.”

Algramo’s origins are rooted in Moller’s days spent “on the ground” in disinvested communities in Chile, where he learned his role in the problem and how he could begin to address it. But as Algramo begins its second round of corporate partnerships, Moller is ready to not only tap into the entrepreneurial spirit of iterating through different ideas, but to call on others to collaborate toward their common problem-solving goals.

Looking for ways to make your virtual events more engaging? Check out Solve’s tips to host an engaging virtual event.

Solve intern Aidan McGovern contributed to this article.

Casey van der Stricht, Greg Shell, and José Manuel Moller speak during the Solving from Anywhere webinar "Impact Investing to Solve World Challenges" on August 4, 2020.

Tags:

- Economic Prosperity

- Sustainability

Related articles

-

Workforce Development for the Future: A Q&A with Michelle Hecht, Executive Vice President, Head of Corporate Affairs, Citizens

-

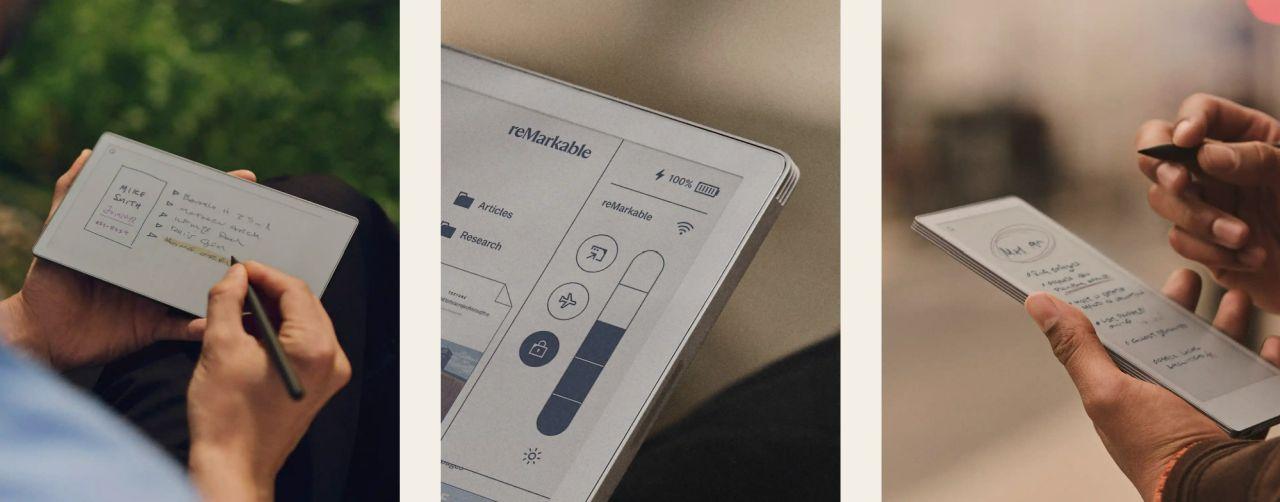

Powered by Purpose: E Ink’s ePaper Technology Takes Aim at the World’s Toughest Problems

Because it draws power only when an image changes—and none at all while static—ePaper reduces energy consumption by orders of magnitude. That single breakthrough unlocks net-zero transit signs, off-grid medical notebooks, and other applications that traditional screens simply can’t power sustainably.

-

MIT Solve Launches $1.5M Global Search for Tech-Enabled Social Innovations

The world's leading social impact platform seeks tech innovators tackling global challenges in Climate, Health, Learning, Economic Prosperity, and Indigenous Communities