Ownally: Digitally Equitized Real Estate

Housing inequality is secretly becoming the biggest problem populations will face in 30 years, with 2.3billion people possibly impacted worldwide. Race, ethnolinguistics, gender, religious background, economic and educational disparities all contribute to a widening homeownership gap globally. The future of cities can no longer be solved by outdated systems.

Ownally is the first digitally-equitized real estate platform powered with geodemographic/location intelligence.

With its ATS-mediated fractional ownership system, it enables homebuyers to afford and invest in properties without drowning in debt, or waiting 15+ years to save capital. The alternative trading system enables homebuyers/homeowners to gradually pay for property at their own pace, or easily liquidate and sell in the future.

Additionally, its location-intelligence combines human-centered data as well as geomorphic-data to holistically project future prices, as well as consider often-overlooked environmental-sustainability risks.

If implemented, it could unlock previously untapped $10-15 trillion markets, with 2.3billion finally gaining access to inclusive homeownership.

According to the World Bank and OECD, around 30-40% of the entire world population will have difficulty accessing affordable housing. This would mean a minimum of 2.3 billion people are at risk of never being homeowners and experience marginalization &displacement in a rapidly urbanizing world.

In Asia, rising property prices are up to 25-35x the average annual salary a household could ever attain. Different ethnicities and socioeconomic groups are at a serious disadvantage with such increasing housing gap and urban displacement.

Developed countries are no exception. In an OECD survey, homeownership rates are decreasing for the past 5 years even among major countries. According to the WEF, in the US alone, as high as 37% of the population are unlikely to own homes throughout their lives. In Switzerland, this number skyrockets to 68%; in Germany as high as 64%; in France 47%; UK 44%, Canada 42%, and Japan 39%.

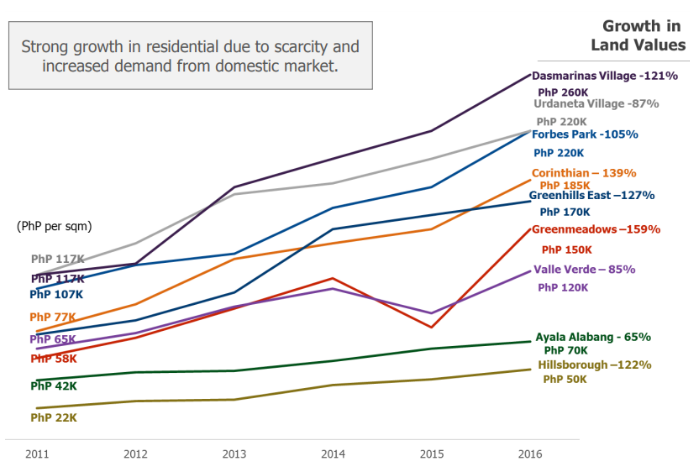

Zooming into the Philippines, about 30-35% of Filipinos may be left behind when it comes to housing opportunities. In the National Capital Region alone, despite it being the economic heart of the country, around 3 million Filipinos have become lifetime and multi-generational renters. Property prices continue to rise near double-digit rates.

Ownally is "Your own ally so you can own, finally."

The deep human-centered platform combines the use of geodemographic intelligence and financial-engineering systems, so that individuals are better, more flexibly able to afford homes without incurring high debt or experience economic or even social insecurity.

Its use of location intelligence (geodemographic-AI) takes a more holistic approach in evaluating and recommending properties across geographies. It considers factors such as disaggregated data on race, religion, gender, economic, ethnolinguistic backgrounds and personal preferences to better understand the needs of the real-estate buyer. Additionally, it factors in environmental data regarding surrounding traffic, local climate, workplaces, social centers, population size, crime rate, and even hazard risks such as flood history or seismic activity to determine future property prices and their sustainability.

Afterwards, financial-engineering methods like fractional ownership and equitization allow the individual to afford the property with better and more flexible payment terms. Instead of leveraging on high debt or relying on enormous savings, the property is equitized into fractional shares so that the individual can pay for these "property shares" gradually and according to financial capability. If ever the buyer's circumstances have changed, the buyer can sell these property shares digitally to other buyers.

While being a universal problem across the world with 2.3 billion people at risk, inclusive homeownership is primarily a major overlooked problem in the Philippines, and the problem is expected to continue and balloon in the next 10 years.

According to the Department of Trade and Industry (DTI), as well as the Philippine Board of Investments (BOI), at least 3.9 million households in the country are currently unable to secure homeownership. The Philippine government expects that even with increased supply from the country's real estate developers, there is a projected jump by 67% of the multigenerational renter population by 2030, amounting to 6.5 million households. This accounts for approximately 32.5 million to 39 million Filipinos never being able to become homeowners and experience internal displacement in a rapidly urbanizing society.

Generally, it takes 15-20 years before interested homebuyers are able to secure capital savings or good credit record to acquire their first home, if ever at all. Average property prices in the National Capital Region are about 10-25 times the average annual household salary Filipinos can ever afford, and in some districts, this would skyrocket up to 35 to 45 times the price-income ratio.

Inclusive finance is unattainable for a vast majority of Filipinos, with 57.2% of the population being declined regarding loan applications. These would in turn encourage more Filipinos to avail of less secure and more expensive options such as loan sharks, payday loans, and other informal financing sources. As such delinquency rates are high, amounting to a 20% non-performing loan (NPL) ratio. This makes the rate of consumer credit defaults in the Philippines almost triple the average in Asia (Malaya, 2008).

Moreover, the Philippines is situated along the Pacific Ring of Fire, and is "overdue" a major earthquake that could disrupt economic activity and the real estate industry. Sustainability metrics must also be considered in proposing any viable real estate solution.

We have conducted participatory studies, field review and FGDs integrating design thinking procedures to extract both qualitative and quantitative insights.

As a result, our solution, Ownally, has indeed focused on human-centered approaches in developing a technology and system that could address the following real-world problems experienced by many Filipinos:

- Equity-based financing rather than debt-based financing, since majority of the population would fail on credit scoring standards or at high risk of default

- Better price and more flexible payment terms where homebuyers can pay gradually at their own pace and according to financial capability

- Possibility to opt out of the home acquisition process, due to family emergencies, employment instability, and other human factors.

- Accounting for geomorphic and climatographic hazards such as flood history, seismic activity, drought frequency, landslide and soil erosion to determine future sustainability, projected valuation and property risks.

- Considering ethnolinguistic, religious, gender and socioeconomic backgrounds for holistic and anti-discriminatory real estate solutions since the Philippines is home to more than 175 ethnolinguistic families, 27 major ethnic groups, 3 major religions, 6 socioeconomic groups, and 5 major foreign citizenship blocs (American, Chinese, Japanese, Indian and Korean).

In the coming years, we expect to expand the scope of our solution to Southeast Asia and East Asia, facing universal problems of lack of inclusive homeownership, rising property prices, and internal displacement among local populations. We have also conducted preliminary market research on South Korea as a case study for our future expansion efforts.

Indeed, across Southeast Asia, around 500 million people are unable to own and afford homes, amounting to an untapped $4.1 trillion real estate market in the ASEAN region alone.

- Scale safe and private digital identity and financial tools to allow people and small businesses to thrive in the digital economy.

Our solution,Ownally, fits perfectly the Challenge: Digital Inclusion, and definitely the subdimension: Scaling private identity and financial tools to allow people to thrive in the digital economy.

As populations centers become increasingly urbanized, and property prices jump, inclusive-homeownership is the biggest overlooked problem in a rapidly-digitalizing economy. Problems are also complex with various geomorphic and sociodemographic factors affecting it such as race,gender,religion and more.

Our solution, Ownally,addresses these problems for urban displaced Filipinos utilizing proptech/fintech financial-engineering and geodemographic intelligence, as a case study for replication to other countries, even the US, for human-centered inclusive homeownership in a digital economy.

- Pilot: An organization deploying a tested product, service, or business model in at least one community.

Ownally is currently in the pilot development stage with pre-seed funding rounds. It has an alpha-version prototype system, demo UI and user dashboard.

Currently, in the Philippines, we have 1,000 pre-registered user applicants, and we are working with the Philippine government technology ministry (DOST) in the R&D and early-stage testing of this technology for the Philippine population. For diversity and inclusion purposes, these user applicants come from various geographic areas across the country, along with various educational, gender, religious, and ethnic backgrounds.

At the moment, we are gathering as much data, feedback and market information via ethnographic field studies, customer journey and user story analysis, and big data sources. Our aim is to determine the optimal form of this technology to address rampant housing inequality, rapidly rising housing prices, and economic mobility problems in the country.

We are also working with various private institutions to advance the promising proptech/fintech solution.

- A new technology

There are various innovative approaches, and possibly even inventive steps, in the technology we are introducing to the very traditional real estate industry.

First, the equitization of real estate (aka fractional ownership) in itself is a very transformative step to unlocking the future of sustainable cities and inclusive homeownership. Throughout the centuries-old history of real estate, most transactions revolve on debt financing or high capital savings. Through an equity-based homeownership model, individuals and families can now own homes at their own pacing, with better costs, more flexible terms, and little to no debt. An entire untapped market of 2.3 billion individuals worldwide can finally access real estate investment and homeownership.

Second, introducing tradeability to these fractional equities is another major innovation that could transform not just real estate but even financial markets at large. When homebuyers or real estate investors need liquidity from their property assets, they can easily transact these collaborated equities to other buyers. It also makes homeownership and pricing more accessible, transparent and affordable to all kinds of people.

Third, utilizing human-centered disaggregated data such as gender, race, ethnolinguistics, religion, education and socioeconomic mobility can holistically change the way we do real estate -introducing much-needed and overlooked dimensions for fully inclusive homeownership and the future of urban populations. Additionally, environmental data such as surrounding traffic, climate, workplaces, social centers and hazard-related geomorphic data can project more grounded future pricing expectations and sustainability risk probabilities.

Lastly, involving elliptic-curve cryptography enables greater financial cybersecurity compared to traditional financial transactions.

- Artificial Intelligence / Machine Learning

- Big Data

- Blockchain

- GIS and Geospatial Technology

- Software and Mobile Applications

- Elderly

- Rural

- Peri-Urban

- Urban

- Poor

- Low-Income

- Middle-Income

- Refugees & Internally Displaced Persons

- Minorities & Previously Excluded Populations

- 5. Gender Equality

- 8. Decent Work and Economic Growth

- 9. Industry, Innovation and Infrastructure

- 10. Reduced Inequality

- 11. Sustainable Cities and Communities

- Philippines

- Indonesia

- Philippines

- Singapore

- Korea, Rep.

Growth of not only the user base but also the vendor base is crucial for the success and sustainability of Ownally.

Currently, Ownally has 1,000 pre-registered user applicants that are part of the nationwide utilization survey to be conducted in partnership with the Philippine government. The composition of the user applicants are as follows:

- 23% from the Philippine Capital

- 32% from the Luzon Islands

- 26% from the Visayas Islands

- 19% from the Mindanao Islands

In the following year, we expect to be able to bulk up our vendor base with the following targets taken into consideration. This would be a strategic move that could influence user base growth as well.

- 60% of the Top 10 Major Property Developers

- 10% of the 3,164-strong companies in the Housing Industry

- 90% of the 160-member strong Subdivision and Housing Developers Authority (SHDA)

- 5% of the 4,242-strong Real Estate Brokers Association of the Philippines (REBAP)

In five years, we expect to serve the following population, assuming expansion into bigger and additional markets as well:

- National Capital Region: 5% of the 14m strong population

- Metropolitan Cebu: 10% of the 2.9m strong population

- Metropolitan Davao: 8% of the 1.6m strong population

- South Korea: 4% of the 50m strong population

- Jakarta metropolitan area, Indonesia: 3% of the 33m strong population

These are market penetration figures based on current financial literacy, investment literacy, and real estate literacy levels from said markets. For example, in South Korea,10% of the population invests in the stock market and crowdfunding alternatives.

As we are currently focusing on our year 1-2 activities, we are only indicating here the key performance indicators that we have set during this period:

Year 1-2: Coalition-Building

- Indicators regarding Top Property Developers:

- Number and Types of Units Integrated

- Historical Pricing Data across Geographies and

- Vacancy and Demographic Data across Geographies

- Geo-demographical Representation (%)

- Indicators regarding Real Estate Brokers and Minor Developers

- Integration Rate (%)

- Utilization Rate (%)

- Feedback Rate (%)

- Satisfaction Rate (%)

- Indicators regarding Nationwide Utilization Study

- Disaggregated data on gender, religion, ethnolinguistic, educational, and socioeconomic background

- Participation Rate (%)

- Feedback Rate (%)

- Satisfaction Rate (%)

- Post-Study Utilization Rate (%)

- Referral Rate (%)

- End-User Profile and Subsegmentation Report

- Business Landscape Analysis

- Customer Journey Report

- UAT Acceptance Rate (%)

- OAT Acceptance Rate (%)

- SLA-AT Acceptance Rate (%)

- CRAT Acceptance Rate (%)

- Usage Defect log %

- Defect Tolerance Rate (%)

- Specific Indicators on Platform Usage

- Monthly Rate of Return (MRR)

- Monthly Unique Visitors

- Monthly Return Visitors

- Clickthrough Rate

- Registration Rate

- Viewership Rate (Social Media)

- Engagement Rate (Social Media)

- Other Considerations among Participating Users

- Pricing Tolerance Range

- Brand Familiarity Survey

- Real Estate Literacy Rate (%)

- Financial Literacy Rate (%)

- Operational Indicators

- EBITDA

- Breakdown-analysis of expenses

Year 2: Scalability Engineering

- Indicators regarding Scalability with Primary Regulatory Bodies:

- # meetings with Housing and Land Use Regulatory Board

- # meetings with Philippine BOI

- # meetings with Department of Information and Communications Technology

- # meetings with Securities and Exchange Commission

- Technology Compliance Checklist (%)

- Financial Institutions:

- Quality Assessment of Provided Information

- Geographical Representation of Banks

- Amount of Funds secured

- For-profit, including B-Corp or similar models

Being an early-stage startup, the company is operating on lean principles and diversity principles for efficiency and growth.

- Full-Time Staff (Leadership Team): 5 people

- Part-Time Staff (Software Programmers): 3 people

- Advisors: 3 people

Our team of 8 hails from five areas of expertise combined:

- Programming & software engineering

- Real estate expertise

- Civil engineering

- Financial engineering

- Startup development

The software engineering team of 3 have backgrounds in location intelligence, smart contracts, DLT & trading systems. Ricsson Ngo, our Chief Technology Officer (CTO) had 5 years experience on Smart Contracts, EVM, Solidity and software engineering. He is also the founder of Timeswap Labs, a fully decentralized AMM based money market protocol democratizing finance.

Our Chief Information Officer (CIO), Michael Maribbay, has come from major banks & finance firms such as HSBC, Citibank and KPMG. He is also in training for the Chartered Financial Analyst (CFA) examinations.

Our Chief Marketing Officer (CMO), Neth Kho, has 20+ years of experience as a registered real estate professional & marketing trainer, working with major real estate developers and a wide range of clientele. She still practices her profession to this day.

Chris Doroja, the Chief Operating Officer (COO), combines his expertise in securities law & startup development. Prior to starting Ownally, he has started his first VC-backed ChemTech startup at 18 years old, and got acquired later on.

Lastly, our Chief Executive Officer (CEO), Bryan Doroja, has at a young age been exposed to real estate and the construction industry through a family-owned construction business. He is a Civil Engineering graduate, project manager & has managed more than 30 people.

Together, the team has noticed gaps in the real estate market, and how technology is inevitable for real estate.

As part of our Company Statement, our team believes workplace diversity as the combining of different backgrounds, experiences, and perspectives, and that taking advantage of these differences is what leads to innovation.

- of different races, ethnicities, genders, ages, religions, disabilities, and sexual orientations

- with differences in education, personalities, skill sets, experiences, and knowledge bases

We prioritize diversity and inclusion by creating our Diversity, Inclusion and Equity Framework which includes the following:

- Creating a focus and strategy at the leadership level

- Creating behavioral standards and holding leaders accountable for results

- Training people at all levels on topics like unconscious bias

- Integrating diversity and inclusion strategies in recruitment, performance management, leadership assessment, and training

- Creating employee networks (e.g, employee resource groups, community outreach groups)

- Accepting and honoring multiple religious and cultural practices

- Strengthening anti-discriminatory policies

- Reporting goals and measuring progress

- Creating an externally visible scorecard to measure progress including metrics for recruiting, promotion rates, compensation levels, turnover, participation in ERGs, and supplier diversity

Some of our diversity and inclusion best practices include:

- fair treatment

- equal access to opportunity

- teamwork and collaboration

- a focus on innovation and creativity

- organizational flexibility, responsiveness, and agility

- conflict resolution processes that are collaborative

- evidence of leadership’s commitment to diversity (e.g., including in the company's strategic and corporate plans)

- representation of diversity at all levels of the organization

- representation of diversity among internal and external stakeholders

- diversity education and training

- Individual consumers or stakeholders (B2C)

At the heart of our mission is solving a universal problem that exists not only in our local boundaries, but even in the United States, Europe and other developed markets as well, where 30-60% of the population are at risk of urban displacement throughout their lifetime. Around 2.3billion do not have access to inclusive homeownership, and could grow in the next 30 years as more than 60% of the world population become increasingly urbanized.

As much as we believe that our pioneering technology solves our local problems on inclusive homeownership in the Philippines, in East and Southeast Asia, we also deeply believe that our technology could prove vital and replicable for other markets as well, with some adjustments to fit regulatory compliance.

This is the primary reason why we applied for MIT Solve (and hopefully succeed): to be able to spread our mission of inclusive homeownership into other markets, and the effective technological tools that make it a beaconing reality.

While we are deeply grateful for the opportunities MIT Solve could bring in terms of overcoming our barriers on world-class talent recruitment, funding opportunities, and research and network collaborations, we also believe that the highest reciprocal value we can give back to MIT Solve and into those that will believe in us, is the mission of making inclusive homeownership a reality not just in our market but into other geographies that need it as well.

Ownally: Enabling billions of people, and unlocking trillion-dollar markets, with just one revolutionary technology.

- Human Capital (e.g. sourcing talent, board development, etc.)

- Financial (e.g. improving accounting practices, pitching to investors)

- Legal or Regulatory Matters

- Public Relations (e.g. branding/marketing strategy, social and global media)

- No, I do not wish to be considered for this prize, even if the prize funder is specifically interested in my solution

- Yes, I wish to apply for this prize

- Yes, I wish to apply for this prize

- Yes, I wish to apply for this prize

- Yes, I wish to apply for this prize

- Yes, I wish to apply for this prize

Chief Operations Officer

Chief Executive Officer

Chief Marketing Officer

Chief Information Officer